Reviewing Your Retirement Plan: 12 Things to Do

A helpful list of things to do to make sure your retirement plan stays on track, even after you turn in your diplomatic passport.

BY JOHN K. NALAND

istockphoto.com / Nuthawut Somsuk

Retirement planning does not end when you turn in your diplomatic passport and agency ID card. Below are a dozen topics that Foreign Service retirees should review from time to time to determine if course corrections are needed in their retirement plans.

1. Review Investment Allocations. If you depend on the Thrift Savings Plan (TSP), Individual Retirement Accounts, and/or other financial investments to fund a portion of your retirement spending, then you should occasionally review the risk-versus-reward balance of those investments.

A key factor is your time horizon. If you or your survivor’s life expectancy makes it likely that 20 or more years from now one or both of you may depend on TSP income to live on, then investing mostly in stocks will protect the funds’ purchasing power from erosion by inflation. But if your time horizon is shorter, and you are currently drawing down those funds to live on, then holding a good portion in bonds will protect that nest egg in the event of a major stock market decline.

As you weigh the best balance, keep in mind that you already have a functional equivalent of a large bond in the form of your federal pension that generates continuing payments like a bond does. Monthly Social Security checks do the same thing. That guaranteed base of income gives you the option of including more stocks in your TSP portfolio.

2. Keep Informed. What you don’t know can hurt you when it comes to rules, procedures, and deadlines for federal retirement benefits. So exercise due diligence by staying informed.

Be sure to review the Department of State’s Foreign Service Annual Annuitant Newsletter posted online at https://RNet.state.gov under the “What’s New?” tab. An updated version is posted each November.

AFSA, of course, offers a wealth of benefits guidance. Check out the Retirement Services web page at https://afsa.org/retirement, the first 25 pages of the AFSA Directory of Retired Members mailed to retirees each December, and occasional emails including the bimonthly AFSA Retirement Newsletter. See the text box below for a list of essential references.

3. Use Online Services. While logging in can be a challenge due to the recent change in procedures to defend against hackers, you can save yourself time if you maintain access to your Annuitant Employee Express account instead of having to call or email to request information or update your Foreign Service annuity records.

The same is true for maintaining online access to your My Social Security, Medicare, and TSP accounts. You can also save time by finding answers to basic questions yourself in online guidance (see “Keep Informed” above). Instructions on how to log on to Annuitant Employee Express are in the 2023 AFSA Directory of Retired Members and on the AFSA Retirement Services web page.

4. Know Who Does What. If you need to contact the government about your retirement benefits, knowing which office does what will save you time and frustration. An important fact to remember is that most support for Foreign Service retirees of all agencies is provided by the State Department, not by the Office of Personnel Management (OPM).

To make benefit changes, report divorce or remarriage, or report federal reemployment, retirees should contact State Department human resources staffers at HRSC@state.gov. For annuity payment questions, contact State Department finance staffers at AnnuityPaySupport@state.gov.

If your issue involves TSP, Social Security, or Medicare, then see those agencies’ websites for contact information. The only reason to contact OPM is for the OPM-managed Federal Employees’ Group Life Insurance (FEGLI) program.

Essential References Available at https://afsa.org/retirement

- State Department Office of Retirement: Foreign Service Annual Annuitant Newsletter

- AFSA Directory of Retired Members: Guidance Section

- AFSA Tool: Retirement Planning Checklist for Current Retirees

- AFSA Tool: Financial Planners, Tax Help, and Estate Planners

- AFSA Tool: Retirement Benefits FAQ for Retired Personnel

- AFSA Video: Reviewing Your Retirement Plan

5. Act on Major Milestones. Be sure to update beneficiary designations for TSP, FEGLI, and other benefits after marriage, divorce, or other relationship changes. Report post-retirement changes in marital status to HRSC@state.gov to revise survivor election and Federal Employees Health Benefits (FEHB) coverage. If you move to a new state, have an attorney there review your will, power of attorney, and advanced medical directive to see if they need updating.

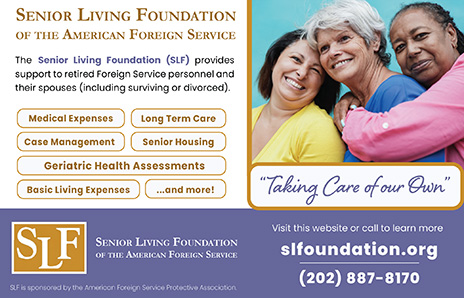

Decide whether to take out long-term-care insurance while you are still healthy enough to qualify. If you are approaching age 62, decide when to file for Social Security. If you are approaching 65, decide whether to sign up for Medicare Part B. If you are approaching age 73 (set to rise to 75 in 2033 under recent legislation), decide what to do about Required Minimum Distributions from taxable retirement accounts.

For more information, see relevant documents on the AFSA Retirement Services web page.

6. Reassess Health Insurance. Review your FEHB coverage every few years during Open Season (mid-November to mid-December). Even if you feel satisfied with your current coverage, switching to another plan could potentially save you money. For example, some plans reimburse $800 a year if you have Medicare Part B coverage.

AFSA helps you weigh your options by giving you access each Open Season to the Consumers’ Checkbook, a great tool for comparing health plans.

7. Remind Family of Survivor Benefits. Because Foreign Service family members are often unfamiliar with offices and functions in the federal agencies, please make sure they know how to report your death to claim their federal survivor’s benefits. The first step is to email HRSC@state.gov or call (866) 300-7419.

Detailed instructions on how to report deaths of Foreign Service retirees is contained in the Department of State’s Foreign Service Annual Annuitant Newsletter and in the AFSA Directory of Retired Members. AFSA recommends that you make a copy of those instructions, show them to your next-of-kin, and file them with your will. In addition, you could assist the executor of your estate by preparing a list of financial accounts, insurance, major assets, and other key information.

8. Avoid Financial Scams. The ever-proliferating number and ingenuity of financial scams pose a growing threat to retirement savings. Use caution when opening emails, clicking on internet links, and answering telephone calls from unknown numbers. Educate yourself and family members about scams and cyberthreats.

Many financial institutions, retail companies, and government agencies publish guidance on how to avoid becoming a victim. For example, on the State Department Federal Credit Union (SDFCU) website, click on Services and then Learning Hub, and then select the category Security in the filter menu.

9. Focus on Health and Wellness. Retirement planning is not all about money. To make the most of your retirement years, you can promote good health through diet, exercise, regular doctor checkups, getting enough sleep, limiting alcohol, and avoiding smoking. Promote wellness by maintaining your connections with family, friends, and social groups.

If you live in one of the nearly 20 states that have a Foreign Service retiree group, consider joining one to maintain social connections and keep intellectually engaged (see the AFSA Directory of Retired Members for a list). You could also volunteer your time at a local nonprofit organization.

10. Downsize. If you have not yet thinned out all the stuff you accumulated over the decades, do not underestimate the amount of time and effort involved in downsizing—especially if you want to gift, sell, or otherwise recycle unused possessions instead of just trashing them.

It is best to start this process long before you face a deadline such as moving to a smaller residence. Many books and websites offer downsizing advice. For Foreign Service–focused suggestions, see Ambassador Eileen Malloy’s “The Big Downsizing: Retirement Lessons,” in the July-August 2015 FSJ (https://afsa.org/big-downsizing-retirement-lessons).

11. Get Assistance from AFSA. Bureaucratic glitches do not end at retirement. Fortunately, AFSA has your back if you encounter difficulties with your federal retirement benefits. Contact AFSA Counselor for Alumni and Retirees Brian Himmelsteib at himmelsteib@afsa.org. He has contacts in State’s Office of Retirement and the Bureau of the Comptroller and Global Financial Services (CGFS) with whom he can raise individual cases when needed.

12. Maintain Your AFSA Membership. Help AFSA defend the active-duty Foreign Service and your earned retirement benefits by maintaining your AFSA membership. AFSA membership keeps you in the loop and keeps you in the community. If your membership depends on you writing a check each year, please consider switching from annual billing to paying dues via annuity deduction. Switching will ensure that your membership does not inadvertently lapse due to lost or unnoticed mail. Email member@afsa.org for more information.

When sharing or linking to FSJ articles online, which we welcome and encourage, please be sure to cite the magazine (The Foreign Service Journal) and the month and year of publication. Please check the permissions page for further details.

Read More...

- “Retirement Planning Shortfalls” by John K. Naland, The Foreign Service Journal, July-August 2013

- “Retirement Planning 101” by John K. Naland, The Foreign Service Journal, May 2016

- “Are You Retirement Ready?” by Donna Scaramastra Gorman, The Foreign Service Journal, January-February 2018

- “AFSA Resources for Retirees” by Delores Brown, The Foreign Service Journal, May 2022